Credit memos can be an important tool to help your business grow. While you may not be versed in handling your company’s finances, as the owner of a small to medium-sized business, it’s imperative that you become accustomed to dealing with invoices and other financial documents as your business continues to grow.

What are Credit Memos and why are they used?

A credit memo is a document that gets sent to a buyer, from a seller as soon as an invoice has been sent. There are a number of reasons why a seller may issue a credit memo to one of its buyers. The top reason is because the buyer returned a purchased item to the seller. Oftentimes the return of the item may be because it’s defective, the wrong colour, the wrong size, or perhaps simply not what the buyer originally envisioned.

The seller may also choose to issue a credit memo because of a price change. This is only the case when the seller has agreed to issue the credit memo for the difference in the new sale price and the price the buyer paid within a given time period.

In some cases, the credit memo can completely reimburse the buyer, making the product free of charge. Unlike a traditional refund, where you’re getting actual currency back from the seller, a credit memo is exactly that, a credit. This document helps you keep better track of your company’s finances and provides the buyer with an incentive to purchase from you in the future.

What should I include in a credit memo?

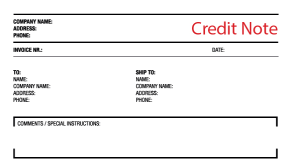

There are several pieces of important information that can be found on a credit memo. Most feature the purchase order number, as well as the terms of payment and billing statement. Additional information that can be found on an accounting credit memo includes the shipping address, the date of purchase, and the list of items, prices and quantities. The information that is provided on a credit memo helps a seller keep track of its inventory.

The knowledgeable accountants at NuVest can help business owners like you with basic tasks such as issuing credit memos, sending out invoices and keeping track of sales. Contact NuVest Management Services to learn more about how you can outsource your accounting needs.