Having a proper understanding of a company’s current financial condition is vital to the management of any organization. The accounting department is responsible for providing management with the necessary data to ensure the continued financial health of the organization. Several metrics and concepts are monitored and used for this purpose. One of the most important metrics that accountants deal with is known as Days Sales Outstanding (DSO).

What is DSO ?

- DSO can be defined as the average number of days taken by an organization to collect the revenue after the conclusion of a sale. In other words, it refers to the average time required for collection. This financial metric can be used to determine how effective the organization is at managing the accounts receivables of the organization.

- Generally, the DSO is calculated on a monthly basis but quarterly or annual calculations are not uncommon. A lower DSO value shows that fewer days are taken by the organization to collect the money due from accounts receivable. A higher DSO value can indicate that the organization sells on credits, taking a longer period of time with its collections.

- The DSO will be typically calculated every month or every period. This way, the accountants and the management can compare their DSO trends, see if any improvements have been made and course correct going forward.

How to Calculate Days Sales Outstanding ?

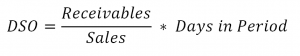

The Days Sales Outstanding calculation is simple:

There are other variations of the formula that can be used by organizations depending on how it conducts its business. However, irrespective of the formula used, the Days Sales Outstanding value will be the same.

How to Improve Your DSO ?

There are a number of processes that can be implemented to reduce DSO and improve an organization’s financial health. Here are few tips:

Reduce Billing Time:

Implementing a process of quicker invoicing can easily reduce the DSO. Delaying the sending of an invoice will cause the customer to take more time to make the payment. For speeding up the billing process, using automation tools can be immensely beneficial. These tools can automate the overall process and reduce the billing period to a few days instead of several weeks. Faster billing also ensures that the payment process is consistent and can encourage clients and customers to pay more quickly.

Incentivize Faster Payments:

Providing customers with incentives can help speed up the payment process. One method is to maintain credit cards on file. This enables the payment to be charged as required without customers having to manually input payment information each time. Of course, it is essential that customers are notified before any charges are made. Ideally, both parties should agree to these details in advance.

Reassess Client Relationships:

For certain clients with high days of sales outstanding, it may be worth reassessing the relationship. The accounting department can help in determining the costs involved in retaining these clients. Typically, the costs arise out of extra activities related to collections, sending multiple invoices as well as the lost use of necessary cash. In some cases, the costs can be detrimental to the organization’s financial health. In these cases, continuing to retain these clients may not be a viable option.

Benefits of DSO Reduction

If the DSO is not reduced, the organization’s finances will be negatively affected. The most discernible of these effects is the loss of cash flow. The absence of cash may make it harder to pay the monthly accounts payable such as operational costs. This in turn makes it more difficult to bring about operational growth. This may create the need for outside financing, resulting in an increased financial burden. Opportunities to expand might be lost while administrative costs arising out of the collections may increase. As such, reducing the DSO has several benefits.

DSO improvement is vital for any organization. The longer the delay in closing accounts receivable, the harder it can be to ensure the financial health of the organization.

Looking to outsource your accounting department? Contact NuVest to see how you can get started